How to Start a Financial Coaching Business: A Comprehensive Guide

Have you ever considered extending your transformative touch to the realm of personal finance?

You're not alone. Financial coaching is a rapidly expanding field that's capturing the interest of coaches just like you.

Why?

Because people need it. Badly. We live in a world that's more financially complicated than ever before. Whether it's millennials grappling with student loans, families trying to make their paycheck stretch, or retirees navigating the complexities of their pensions, the demand for financial guidance is skyrocketing.

That's where financial coaching comes in. It's about empowering individuals to understand their finances, make wise decisions, and create sustainable financial habits.

But let's pause for a second. You might be wondering, "How do I even start a financial coaching business? What steps do I need to take?"

Well, you're in luck!

You've landed on the ultimate guide designed specifically for coaches like you. We'll unpack the ins and outs of the financial coaching field, discuss the earning potential, and explore necessary training and certifications. You'll also discover how to attract your first clients, develop your brand, and even learn about the essential resources you need to make your business a success.

So, are you ready to embark on this journey? Let's dive in and find out if starting a financial coaching business is the right next step for you.

Here’s what we’ll cover:

Financial Coaching Uncovered: Is It Your Perfect Match?

We're going to dissect what financial coaching is all about, and help you decide if this is the career path for you. Buckle up!A Look into the Earnings of a Financial Coach

Let's talk numbers. How much can you expect to earn as a financial coach? We'll dive deep into the potential earnings and growth prospects.The Importance of Training and Education in Financial Coaching

Like any profession, financial coaching requires specific skills. We'll go through the importance of proper training, education, and helpful resources to get you started.From Idea to Reality: Kickstarting Your Coaching Business

We'll guide you through the initial steps, from crafting a solid business plan to understanding your legal requirements.Tools of the Trade: Essential Resources for Your Financial Coaching Business

We're sharing our favorite tech and resources that are essential for managing and growing your business efficiently. Think of these as your business best friends!Building a Strong Personal Brand and Drawing in Clients

Your brand is your business's identity. We'll share tips on crafting a compelling personal brand and strategies to attract your first clients.Spreading the Word: Effective Marketing Strategies for Your Services

Ready to shine in the world of financial coaching? Let's talk about marketing strategies that'll help your services stand out from the crowd.Scaling for Success: Growing Your Financial Coaching Business

The ultimate goal is growth, right? We're diving into strategies for business expansion and sharing some inspiring success stories to motivate you.

Financial Coaching Uncovered: Is It Your Perfect Match?

So, what exactly is financial coaching? Simply put, it's a rewarding profession that empowers individuals to take control of their financial destiny.

Just like a sports coach or fitness trainer, a financial coach guides individuals to reach their financial goals and dreams. This could be anything from getting out of debt, saving for a home, planning for retirement, or simply learning to manage their money better.

The role is about promoting proactive, rather than reactive, financial behaviors.

The Pros and Cons

Choosing to become a financial coach comes with its unique set of pros and cons. Let's consider some of them:

Pros:

The opportunity to make a meaningful difference

Flexibility in setting your own hours

Income potential directly tied to your effort and commitment

Cons:

It requires your patience and emotional resilience

You'll be encountering clients in stressful financial situations

The common challenges and uncertainties of starting a business

Do You Have What It Takes?

So, what personal traits and skills do you need to be a successful financial coach? To succeed as a financial coach, you need certain personal traits:

Genuine desire to help others

Excellent listening skills and empathy

Patience and emotional resilience

Self-motivated and organized

Comfortable with numbers and teaching complex concepts simply

If you're nodding along to these traits and feeling a tingle of excitement at the prospect, then you might be onto something. Financial coaching could be a brilliant extension or pivot for your coaching career.

A Look into the Earnings of a Financial Coach

One of the key factors to consider when diving into a new career is, naturally, the earning potential. So let's talk money!

What can you expect to earn as a financial coach?

While there isn't a one-size-fits-all answer, financial coaches typically charge rates based on various factors, such as their experience, location, level of specialization, and the complexity of the client's financial situation.

Currently, hourly rates can range anywhere from $50 to over $200. Some coaches also offer package rates or monthly retainer fees, which can be a steady source of income.

Your earnings as a financial coach aren't just dictated by what you charge your clients. Several other factors come into play:

Experience and Reputation: As with any profession, the more experience and positive client testimonials you have under your belt, the more you can generally charge for your services.

Location: If you're in a big city or a high-cost-of-living area, you may be able to charge more than if you're based in a smaller town.

Specialization: If you specialize in a niche area of financial coaching, such as helping small business owners or clients with high net worth, you may be able to command higher fees.

Services Offered: Coaches who offer more comprehensive services or additional resources (like webinars, courses, or materials) can often charge more.

Now, what about the future?

Financial coaching is a field with excellent income growth potential. Your earnings can increase significantly as you gain more experience, expand your client base, and possibly branch out into other related areas (like speaking engagements, authoring a book, or creating online courses).

Remember, this isn't a get-rich-quick scheme. It requires time, effort, and a steadfast commitment to your clients and your craft.

The Importance of Training and Education in Financial Coaching

We've talked about what financial coaching is and the earnings potential it holds. Now, let's dive into the key aspect that will set you up for success in this field: training and education.

Unlike some careers, becoming a financial coach doesn't require a specific degree or a finance background. However, that doesn't mean you can jump in without any preparation.

A strong understanding of personal finance concepts is essential, along with honed coaching skills, to guide your clients effectively. This is where certifications and ongoing education come in.

Earning a certification in financial coaching can give you the necessary skills and knowledge and add credibility to your practice. Clients often feel more comfortable working with a coach who has taken the time to get certified—it shows commitment and professionalism.

Here are some valuable resources for training and certification programs in financial coaching:

The Financial Coach Academy: This comprehensive training program offers online and in-person courses covering the technical, emotional, and business sides of financial coaching.

The American Financial Education Alliance (AFEA): AFEA offers a Certified Personal Financial Coach (CPFC) program focusing on personal finance and coaching skills.

Dave Ramsey's Financial Coach Master Training: A well-respected program, it equips coaches with the tools to help clients eliminate debt, save for the future, and give generously.

Certified Financial Education Instructor (CFEI) Program: The National Financial Educators Council offers this certification for those interested in teaching personal finance.

Remember, becoming a financial coach is not just about acquiring knowledge. It's also about staying up-to-date. The financial world is dynamic, and laws, products, and best practices can change frequently.

Ongoing education, through webinars, conferences, online courses, or networking with other professionals in the field, is crucial to stay current and provide the best service to your clients.

From Idea to Reality: Kickstarting Your Coaching Business

Now we're getting into the nitty-gritty: how to lay the groundwork for your financial coaching business. Starting any business involves careful planning, legal considerations, and some paperwork.

Let's break it down:

Developing a Business Plan:

This is your roadmap. It outlines your business's mission, target market, services offered, pricing, marketing strategy, and financial projections.

Your business plan doesn't need to be a novel, but it should clearly define the path you intend to take.

Here are some additional resources for developing your business plan:

SBA's Business Plan Guide: This resource from the U.S. Small Business Administration provides step-by-step instructions for creating a business plan.

Bplans.com: This site offers over 500 free sample business plans across various industries.

Choosing a Business Structure:

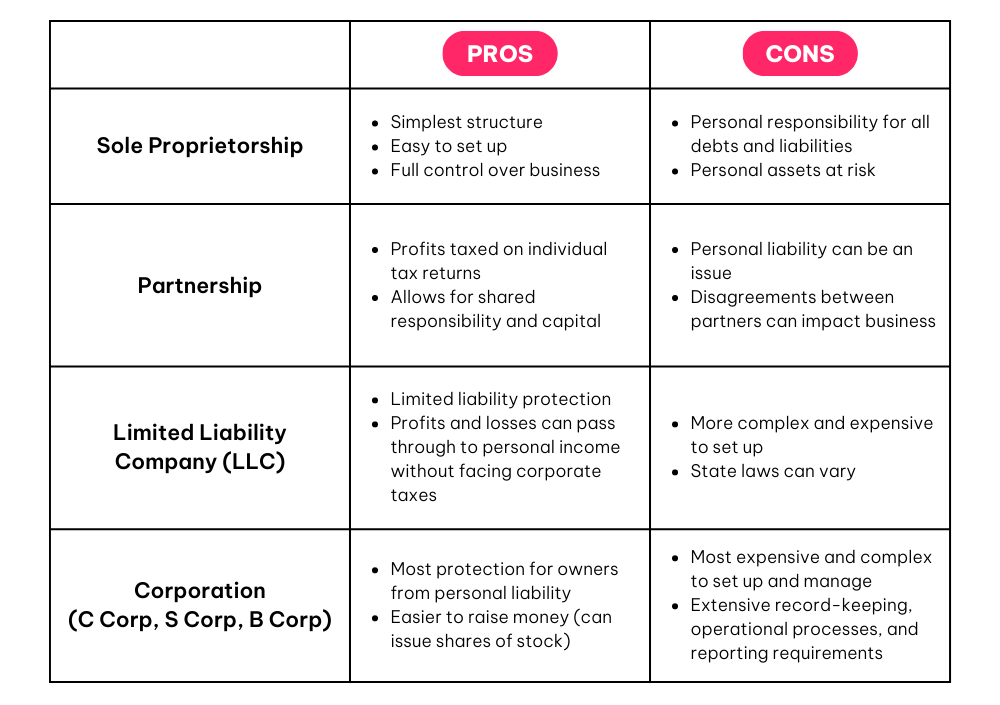

You'll need to decide if your business will be a sole proprietorship, a limited liability company (LLC), a partnership, or a corporation. Each has its own legal and tax implications:

A sole proprietorship is the simplest form. You own the business entirely and are personally responsible for its debts.

An LLC provides some protection from personal liability, but it's more complex to set up and involves additional reporting and fees.

A partnership or corporation might be the way to go if you plan to co-own your business or expect rapid growth.

Consulting with a business attorney or an accountant can help you decide the best structure for your unique circumstances.

Here are some additional resources for deciding which business structure to go for:

Choosing a Business Structure: Another excellent resource from the U.S. Small Business Administration that explains the different types of business structures and how to choose one.

Nolo's Guide to Single-Member LLCs: This guide provides valuable information for those considering setting up a single-member LLC.

Legal Considerations and Paperwork:

Depending on your business structure, you may need to file paperwork to register your business with your state. You'll also need to consider insurance to protect yourself and your business.

Be sure to understand the licensing requirements in your state, as some may require specific permits or licenses for financial coaches.

Here are some additional resources to assist you with this step:

Register Your Business: The U.S. Small Business Administration again comes to the rescue with a step-by-step guide to registering your business.

LegalZoom: For those who prefer a more hands-off approach, LegalZoom offers services to help with business formation, registration, and legal document review.

Remember, it's always a good idea to consult with a business attorney or accountant when setting up your business to make sure you're on the right track legally and financially. They can provide advice tailored to your specific situation and goals.

These steps are your first giant leap toward making your financial coaching business a reality. Yes, it's administrative and can feel a bit dry, but think of it as crafting the solid foundation your business needs to grow and thrive.

Tools of the Trade: Essential Resources for Your Financial Coaching Business

With your financial coaching business's groundwork in place, it's time to consider the tools you'll need to operate efficiently and deliver top-notch service to your clients. Let's take a look:

Technology and Software Needs

As a financial coach, technology is your best friend. Here are some software tools that can help streamline your operations:

Client Management Software: Tools like Clarityflow, Practice Better, or Satori help manage client scheduling, session notes, billing, and more in one place.

Budgeting and Financial Planning Software: Tools like Mint, You Need a Budget, or Tiller Money can help you and your clients track spending and plan for financial goals.

Virtual Meeting Software: You'll likely need to meet with some clients remotely, so platforms like Zoom or Google Meet are a must. In addition to synchronous platforms, Clarityflow offers asynchronous communication options, perfect for remote client consultations fitting into your schedule.

Email Marketing Software: Tools like Convertkit, Mailchimp, or Constant Contact can help you keep in touch with current clients and attract new ones.

Clarityflow offers seamless integration with ConvertKit and many other useful tools!

Importance of Professional Memberships and Subscriptions

Being part of a professional organization can provide a wealth of benefits, from networking opportunities to ongoing education.

Consider joining organizations such as:

Subscriptions to financial publications can also help keep you up-to-date with industry news and trends.

Here are a few subscription-based financial publications to consider:

Investor's Business Daily - Aimed at investors and financial professionals, this publication offers detailed analysis and actionable insights on the stock market.

Kiplinger - Kiplinger offers advice on investing, personal finance, retirement planning, taxes, and more.

Money Magazine - Money Magazine provides a wide variety of information on personal finance, investing, retirement, and lifestyle.

Advisor Perspectives - This publication is aimed at financial advisors, offering insights and strategies for wealth management and financial planning.

Recommended Resources and Tools

Aside from the above, here are some additional resources that can be beneficial to your practice:

Books: The good ol' faithful! A wealth of knowledge is available in books such as "Your Money, Your Life" by Vicki Robin and "The Total Money Makeover" by Dave Ramsey. These can provide valuable insights for your coaching practice.

Podcasts: Financial podcasts like "The Dave Ramsey Show" or "So Money with Farnoosh Torabi" can keep you informed and provide fresh perspectives on money management.

Courses: Continuing education courses, like those offered by the Financial Coach Academy, can help you stay at the forefront of your field.

Blogs and Websites: Regularly visit sites like FinancialMentor, Nerd's Eye View, or Financial Planning Association for insightful articles and ongoing education.

Remember, the best tools are the ones that help you serve your clients effectively while also making your job easier. The right mix of tools will likely vary from coach to coach, so don't be afraid to experiment and find what works best for you!

Building a Strong Personal Brand and Drawing in Clients

Your personal brand and your ability to attract clients are closely intertwined. A strong brand can help you stand out from the crowd, convey your unique value, and draw your ideal clients to you. Let's explore how you can build your brand and leverage it to attract your first clients.

Understanding the Importance of a Strong Personal Brand

Your personal brand is a combination of your unique skills, experiences, and personality. It's what sets you apart from other financial coaches and makes you memorable in the minds of your potential clients.

A strong personal brand can help you establish credibility, build trust, and attract clients who resonate with your approach.

Crafting Your Unique Selling Proposition (USP)

Your USP is a clear statement describing your unique value, how you solve your clients' needs, and what distinguishes you from the competition. To craft a compelling USP, consider the following:

Identify the needs of your target clients: Understand what they're looking for in a financial coach. This could be anything from specific financial advice to a supportive coaching style.

Highlight your unique attributes or skills: Maybe you have a strong background in debt reduction, or perhaps your approach is highly personalized. Whatever makes you stand out, make it known!

Communicate the benefits: Tell potential clients how they will be better off by choosing your services. Will they save time? Money? Be more confident in their financial decisions?

Tips for Creating and Maintaining a Personal Brand

Crafting your personal brand begins with introspection. Understand your strengths, your unique coaching style, your values, and the unique benefits you bring to your clients. Here are a few steps to help you start:

Identify your brand values: What principles guide your coaching practice? Your values could be things like transparency, empathy, or dedication to client success.

Know your target audience: Who are you trying to help? What are their challenges and goals?

Craft a compelling brand message: This message, which should be reflected in all your communications, articulates what you do, who you do it for, and how you provide value.

Consistency is key: Your branding should be consistent across all platforms and interactions, from your website and social media profiles to how you communicate with clients.

Using Social Media and Online Platforms to Promote Your Brand

Digital platforms are powerful tools for building and spreading your personal brand and attracting clients.

Here's how to make the most of them:

Professional Website: Your website is your online home base, a place where potential clients can learn more about you, your services, and how you can help them.

Social Media: Platforms like LinkedIn, Twitter, Facebook, and Instagram can help you reach a larger audience, share valuable content, and engage with potential clients.

Blogging or Vlogging: Sharing your insights on financial matters can establish you as an expert in your field and attract clients who resonate with your message.

Online Networking: Join online communities and forums where your target clients hang out and participate in discussions. This can increase your visibility and credibility.

While your personal brand is an ongoing project, attracting your first clients is a one-time challenge. You'll need to keep refining and promoting your brand as your coaching practice evolves. However, once you have a few satisfied clients, they can refer others to you, helping to grow your business.

Building Relationships and Networking

Networking is crucial in the coaching industry. Attend industry events, join relevant online communities, and connect with other professionals. Foster relationships within your industry and with potential clients.

This expands your network and increases the chances of referrals and collaborations.

Spreading the Word: Effective Marketing Strategies for Your Services

Whether you're just starting out or have been in the business for a while, effective marketing is vital for attracting new clients and growing your financial coaching business.

Let's explore the steps to creating an effective marketing strategy.

Developing a Marketing Plan

A marketing plan outlines how you'll attract and retain clients. It includes understanding your target audience, setting marketing goals, choosing marketing strategies, and setting a budget. The plan should be flexible enough to adapt as your business grows and changes.

To help with creating your plan, here are some free marketing plan templates you might find helpful:

HubSpot's Free Marketing Plan Templates: HubSpot offers a variety of marketing plan templates for different industries, along with a free marketing plan generator.

SmartSheet's Marketing Plan Templates: SmartSheet offers several free marketing plan templates specifically designed for Excel. They offer a range of options, including annual marketing plan templates, social media marketing plan templates, and more.

MailChimp's Marketing Plan Template: This template is ideal for small businesses and startups. It provides a simple structure for planning all your marketing activities.

Leveraging Online Marketing Tools and Strategies

The internet provides a wealth of opportunities to reach your target audience. Here are some strategies to consider:

SEO (Search Engine Optimization): Optimize your website so that it ranks highly in search engine results. This could involve keyword research, improving site speed, and ensuring your site is mobile-friendly.

Content Marketing: Regularly publish helpful content on your blog or social media channels that addresses your target audience's needs and challenges. This helps establish you as an expert and build trust with potential clients.

Email Marketing: Collect email addresses from website visitors and send them regular newsletters with valuable content and updates about your services.

Social Media Marketing: Use platforms like LinkedIn, Facebook, Twitter, and Instagram to promote your content, engage with followers, and reach a larger audience.

Paid Advertising: Consider pay-per-click (PPC) advertising or social media ads to reach a targeted audience.

Building Partnerships and Collaborations

Partnering with other businesses or influencers can extend your reach and bring in more clients. These partnerships could include guest blogging, cross-promotions, or hosting webinars together. You could also join professional organizations to network with others in your industry and gain visibility.

Remember, effective marketing requires regular evaluation and adjustment. Keep track of what works and what doesn't, and don't be afraid to try new strategies.

Check out our article, Marketing for Coaches, for an in-depth look at marketing strategies to boost your results!

Scaling for Success: Growing Your Financial Coaching Business

Just like your clients, your business also has the potential to grow and scale. But expanding a business requires careful planning and strategic decision-making. So let's talk about some strategies for scaling your financial coaching business.

Strategies for Business Expansion

The first step to scaling is understanding your current capacity and identifying areas where you can expand. This might mean offering new services, targeting new markets, or leveraging technology to serve more clients. Here are a few strategies to consider:

Productize your services: Create digital products, like e-books or online courses, that deliver your expertise to a wider audience without requiring your time and attention for each individual client.

Group Coaching: Consider offering group coaching sessions. This approach can serve more clients simultaneously, increasing your income while keeping your services affordable for clients.

Partnerships: Partner with other businesses that serve the same target audience. This could help you reach more potential clients without significantly increasing your marketing expenses.

Hiring and Team Building Considerations

As your client base expands, you'll find yourself needing more help to manage all the moving parts of your business. Consider hiring a virtual assistant to handle administrative tasks, a marketing expert to amplify your reach, or even other coaches to handle client overflow. As you build your team, keep in mind:

Invest in employee growth: Encourage continuous learning and professional development. This not only benefits your business but also helps retain your talented team.

Communicate openly and regularly: A successful team needs clear, consistent communication. Regular team meetings and open channels of communication can help keep everyone on the same page.

Delegate responsibilities: As the business owner, you don't need to do everything. Delegate tasks that others can handle so you can focus on coaching and growth strategies.

Contract specialists: For tasks that require special skills or short-term projects, consider hiring freelance specialists. This can include website designers, copywriters, or SEO experts.

Success Stories of Financial Coaches Who Have Scaled Their Business

Sometimes, the best inspiration comes from those who've been there before. Here are a few examples of financial coaches who successfully scaled their businesses:

Patrice Washington, who, after hitting rock bottom during the 2008 recession, rebuilt her life and finances and is now a successful coach, speaker, and author teaching money management, wealth building, and financial well-being.

Tiffany Aliche, The Budgetnista, who has taken her passion for financial literacy and built a thriving business. She's authored several books, has a podcast, and created a successful online academy, helping thousands of women worldwide to take control of their finances.

Ramit Sethi, who turned his blog into a successful online business offering digital products, courses, and one-on-one coaching.

Scaling your business isn't always easy, but it can be incredibly rewarding.

With the right strategies, a solid team, and perhaps a bit of inspiration from those who've paved the way, you can grow your financial coaching business beyond your wildest dreams.

The Journey Begins: Embrace Your Financial Coaching Venture

So there you have it – a comprehensive guide to starting your financial coaching business. With this roadmap, you're now equipped with the knowledge and resources to build a solid foundation, attract clients, craft a unique brand identity, and scale your business for success.

As we've seen, this path isn't always easy, and there will be challenges. Yet the reward of helping others gain financial clarity and freedom is undoubtedly worth it.

Keep learning, stay adaptable, and remember: each step you take is one step closer to creating a lasting impact through your financial coaching services.

And as you set up and expand your business, consider using Clarityflow to manage your coaching practice. With tools for client management, asynchronous meetings, and much more, it's a comprehensive solution designed to streamline your operations and enhance service delivery. Don't just take our word for it. Try Clarityflow today and experience the difference!