How to Write an Invoice: Your Guide to Professional Invoicing

Have you ever found yourself staring at your screen, unsure how to write an invoice that looks professional and accelerates your business cash flow?

Well, you're not alone.

Whether you're a small business owner, a freelancer, or a start-up founder, knowing how to write an invoice is a critical skill. But it's more than just listing what you sold on a piece of paper - it's about ensuring you get paid promptly and maintaining a positive relationship with your clients.

By the end of this article, you'll have the knowledge and resources to create invoices that look professional and get you paid faster.

So, if you've been wondering how to write an invoice, you're in the right place. Stick around, and let's get started on accelerating your business cash flow one invoice at a time!

Here’s what we’ll cover:

Understanding Invoices: What They Are and Which Types Matter for Your Coaching Business

Get a clear definition of invoices and discover the types that are relevant to your coaching business, ensuring you stay informed.Key Elements of an Invoice: Building Blocks for Prompt Payment

Explore the essential components that make up an invoice and learn how to include them to encourage prompt payment from your clients.How to Number Invoices: Ensuring Organization and Efficiency

Understand the importance of invoice numbering and discover best practices to maintain an organized and efficient invoicing system.Step by Step: Crafting an Invoice That Gets You Paid

Follow a detailed guide that walks you through the process of structuring and writing an invoice, ensuring accuracy and professionalism.Leveraging Tools and Software for Effortless Invoicing

Discover powerful tools and software options that can simplify your invoicing tasks, making the process more efficient and streamlined.Best Practices for Professional Invoicing: Enhancing Your Brand Image

Learn the best practices for creating professional invoices that reflect your brand image and promote positive client relationships.

Understanding Invoices: What They Are and Which Types Matter for Your Coaching Business

So, what exactly is an invoice?

In essence, an invoice is a document you, as a coach, send to your clients to request payment for your services. It lists the services you've provided, their costs, and the payment method and due date.

But not all invoices are identical. Depending on your coaching services, you might need to use different types:

Proforma Invoice: This is a sort of 'preview' invoice you send before offering your services. It provides your clients with an idea of the expected costs, enabling them to budget effectively.

Interim Invoice: If you're working with a client over a longer term (like a six-month coaching program), interim invoices can be handy. Instead of invoicing the entire amount at the end, you'd send these invoices at regular intervals, say monthly or quarterly.

Final Invoice: This is the invoice you send once all services have been delivered. It's the final call for payment, usually sent after a project's completion or at the end of a coaching program.

Past Due Invoice: If a client hasn't settled their bill by the due date, you may need to send a 'past due' invoice. This is a gentle reminder that their payment is overdue.

Understanding how to write an invoice - and which type to use - is crucial for effectively managing your coaching business's cash flow.

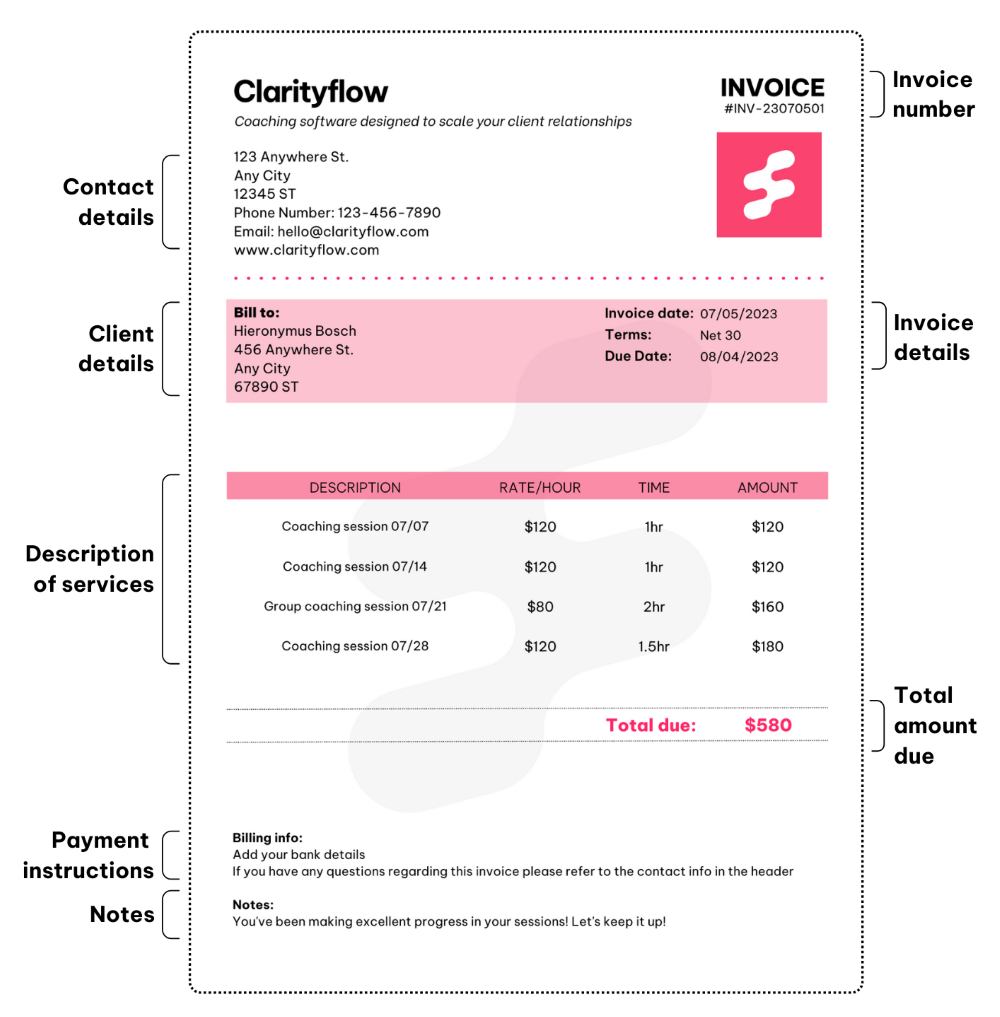

Key Elements of an Invoice: Building Blocks for Prompt Payment

When it comes to crafting an effective invoice, several key elements should be included. By including these components and employing strategies that encourage prompt payment, you can streamline your billing process and ensure a smooth cash flow for your coaching business.

Let's take a detailed look at the key elements that should be included:

1. Contact information:

Start by providing your contact information at the top of the invoice. This includes your name or your coaching business name, address, phone number, and email address. Having your contact details readily available ensures that clients can reach out to you easily.

2. Client information:

Include the client's name or business name and their address (if applicable). This helps identify the recipient of the invoice and ensures accurate record-keeping.

3. Invoice details:

Assign a unique invoice number to each invoice for easy tracking. Add the invoice date to indicate when the invoice was issued. Specify the payment due date, which informs your clients when payment is expected. Additionally, clearly state the terms of payment, including accepted payment methods, payment terms, and any late payment penalties or early payment incentives. This sets expectations and encourages timely payment.

4. Description of services:

Itemize the coaching services or sessions you provided. Provide detailed descriptions for each service, including the quantity (if applicable) and the price per service or session. This breakdown helps your clients understand what they are being billed for and avoids any confusion or disputes. Calculate the subtotal for each item/service to provide transparency in the billing process.

5. Total amount due:

Sum up the individual amounts to calculate the total amount due. This provides a clear and easily identifiable figure that your clients need to pay.

6. Additional information:

If applicable, include any taxes or fees associated with the services provided. If there are any additional charges or discounts, make sure to include them here as well. This ensures transparency and accuracy in the invoice calculation.

7. Payment instructions:

Clearly communicate how your clients should make payment. Provide instructions on the preferred payment method, such as bank transfer, online payment portal, or mailing a check. If necessary, include specific payment details such as your bank account information or a payment portal link. Making the payment instructions clear and easily understandable simplifies the payment process for your clients.

8. Notes or special instructions (optional):

If there are any additional notes or special instructions you want to convey to the client, this is the place to include them. It could be a personalized message of gratitude or any other information relevant to the payment process.

By including these key elements on your invoice, you ensure that all the necessary information is clearly presented, creating a professional and effective invoice that promotes prompt payment and fosters positive client relationships.

How to Number Invoices: Ensuring Organization and Efficiency

Invoice numbering is crucial for several reasons. It allows you to easily identify and retrieve specific invoices, simplifies bookkeeping and payment reconciliation, and ensures accurate financial records for tax purposes.

Additionally, it showcases professionalism and instills confidence in your clients.

To ensure effective invoice numbering, follow these best practices:

Sequential numbering: Use a sequential numbering system, assigning a unique number to each invoice in numerical or alphanumeric order.

Chronological numbering by date: Consider numbering invoices chronologically based on the date of issue. This method provides a clear indication of the invoice's timing and helps with sorting and organizing invoices.

Clear and consistent format: Establish a clear and consistent format that aligns with your business and is easy to understand.

Prefix or suffix: Consider using a prefix or suffix to categorize invoices (e.g., "INV" for regular invoices, "EST" for estimates), aiding classification and record-keeping.

Separate numbering for periods: Reset the invoice numbering at the start of each period (monthly or yearly) to maintain organized records.

By implementing these best practices and tips you'll maintain an efficient and well-organized invoice numbering system, streamlining your financial management processes.

Step by Step: Crafting an Invoice That Gets You Paid

Now that we've covered the key elements of an invoice, let's dive into the process of structuring and writing one. By following these step-by-step instructions, you'll be able to create professional invoices that effectively communicate your coaching services and facilitate timely payments.

1. Start with a Standard Layout

Begin by setting up a standard layout for your invoice. Typically, this involves placing your business logo and contact information at the top, followed by the client's details. Then, leave some space for the invoice number, date, and payment terms. This layout establishes a professional look and ensures all necessary information is clearly presented.

2. Itemize Your Services and Prices

List each coaching service or session you provided, along with its corresponding price. Be specific and descriptive in your item descriptions to avoid any confusion. Consider using bullet points or numbering for clarity. Total up the costs at the end to provide a clear overview of the amount due.

3. Include Payment Terms

Clearly specify the payment terms, such as the due date and accepted payment methods. If you offer any early payment incentives or discounts, make sure to mention them here. Setting clear expectations regarding payment helps avoid delays and facilitates a smooth payment process.

4. Choose the Right Timing

Determining the right time to send an invoice is crucial. In most cases, it's best to send the invoice immediately after providing the coaching service or upon completion of a specific milestone. By sending the invoice promptly, you demonstrate professionalism and increase the likelihood of receiving timely payment.

5. Select Your Delivery Method

Consider the various options available for sending your invoice. Email is a common and convenient method, allowing for easy tracking and quick delivery. Alternatively, you can send a physical copy via mail if your clients prefer a hard copy. Utilizing invoicing software can also streamline the process, providing you with templates and automation features.

By following these step-by-step instructions and structuring your invoice effectively, you'll create a professional document that clearly communicates the details of your coaching services and encourages timely payment.

Remember, promptness in sending your invoice and providing clear payment terms are key to maintaining a positive relationship with your clients and ensuring a smooth cash flow for your coaching business.

We've prepared a handy checklist to ensure you include all the essential elements in your invoice. Use it as a guide while creating your invoice, so you don't miss any crucial details.

Leveraging Tools and Software for Effortless Invoicing

Invoicing tools and software can greatly simplify the invoicing process, making it more efficient and professional. Let's explore some popular tools and software options that can assist you in creating, sending, and managing your invoices:

Invoicing Software:

Dedicated invoicing software, such as FreshBooks, QuickBooks, or Zoho Invoice, offer comprehensive features to streamline your invoicing process. These tools provide customizable invoice templates, automated invoicing, and built-in payment gateways, allowing you to create professional invoices, send them with ease, and track payments effortlessly.

Online Invoicing Platforms:

Online invoicing platforms like Wave, Invoice Ninja, or PayPal Invoicing provide a user-friendly interface to generate and send invoices online. They often offer additional features like invoice tracking, payment reminders, and integration with payment processors.

Accounting Software:

If you're using accounting software like Xero, QuickBooks Online, or Sage, they often include invoicing capabilities as part of their comprehensive financial management suite. These software solutions integrate invoicing with other accounting functions, allowing for seamless invoice creation and payment tracking.

Template-Based Tools:

If you prefer a simpler approach, you can utilize template-based tools like Microsoft Excel or Google Sheets. These spreadsheet applications offer invoice templates that you can customize to suit your coaching business's branding and needs.

When exploring these tools and software options, consider their features, pricing plans, and user reviews to find the one that best aligns with your invoicing requirements.

Integrated Invoicing Tools:

In addition to dedicated invoicing software and online platforms, there are tools that offer integrated invoicing capabilities as part of their broader features. These tools provide a seamless experience by combining invoicing with other functions relevant to your coaching business. Let's explore a couple of examples:

Clarityflow: Clarityflow is a comprehensive coaching platform that includes integrated payment features. Alongside client onboarding, in-app async coaching, and progress tracking, when you sell coaching through Clarityflow, your customers get an easy-to-use customer portal where they can update their payment methods, see their payments history, manage their subscriptions, and download their invoices. This integrated approach ensures a smooth workflow and reduces the need to switch between different applications.

Paperbell: Paperbell is another all-in-one coaching software that combines client management, scheduling, and invoicing into a unified platform. With Paperbell, you can create customized invoices, track payments, and manage client appointments in a single, user-friendly interface. This integrated approach simplifies your administrative tasks and enhances the client experience.

When considering integrated invoicing tools, evaluate their specific features, pricing, and user reviews to find the one that best suits your coaching business needs.

For additional resources and templates to assist you in creating invoices, here are some useful links:

These resources provide a variety of professionally designed invoice templates that you can customize to align with your branding and invoicing requirements. They offer a convenient starting point for creating visually appealing and well-structured invoices.

Best Practices for Professional Invoicing: Enhancing Your Brand Image

Maintaining a professional image throughout your invoicing process is essential for your coaching business. Follow these best practices to ensure your invoices reflect professionalism and contribute to a positive client experience:

Consistent Branding: Incorporate your branding elements into your invoice design to reinforce your identity and promote brand recognition.

Polite and Professional Language: Use polite and professional language, express gratitude for your clients' business, and clearly outline the service details. Remember, your invoice is an opportunity to nurture a positive client relationship.

Clear and Itemized Descriptions: Provide detailed descriptions and itemized prices, promoting transparency and avoiding confusion.

Prompt Invoicing: Send invoices promptly after services are provided or a milestone is reached to demonstrate professionalism and help clients manage their financial responsibilities.

Professional Payment Terms: Clearly communicate payment terms, including due dates and accepted methods, with a friendly and respectful tone.

Organized Record-Keeping: Keep organized records of your invoices for easy reference and accurate bookkeeping.

By implementing these best practices, you present yourself as a professional coach, enhance your brand image, and build trust with your clients.

Streamline Your Invoicing for Success

Invoicing is a vital aspect of running a successful coaching business, and mastering the art of creating professional invoices can significantly impact your cash flow and client relationships.

We get it, it can be daunting. But with a professional invoicing system in place, you can focus on what you do best—providing exceptional coaching services to your clients.

By implementing the practices and utilizing the tools discussed, you can streamline your invoicing process, present professional invoices that facilitate prompt payment, and enhance your brand image.

Take advantage of integrated invoicing software like Clarityflow to centralize your invoicing and client management tasks, saving you time and effort.